Legacy gifts, such as bequests, are made through charitable estate planning and can have significant tax advantages for you and your heirs.

There are many additional reasons to consider a legacy gift:

- Charitable bequests are viewed as one of the most meaningful expressions of gratitude for care received.

- It allows you to leave a legacy in an area that may be close to your heart.

- You may be able to make an impact greater than you thought possible.

- Legacy donors may be eligible for special recognition and amenities.

If you have included us in your estate plans, or are considering it, we cannot thank you enough. Many breakthroughs in medicine and research are made possible by charitable donations, including Legacy Gifts. Our experienced staff can work confidentially with you and your financial advisors to help ensure your charitable wishes are fulfilled. Please contact Andy Trilling, Vice President of Principal Gifts, at 310-449-5246 or [email protected]

Legacy Society

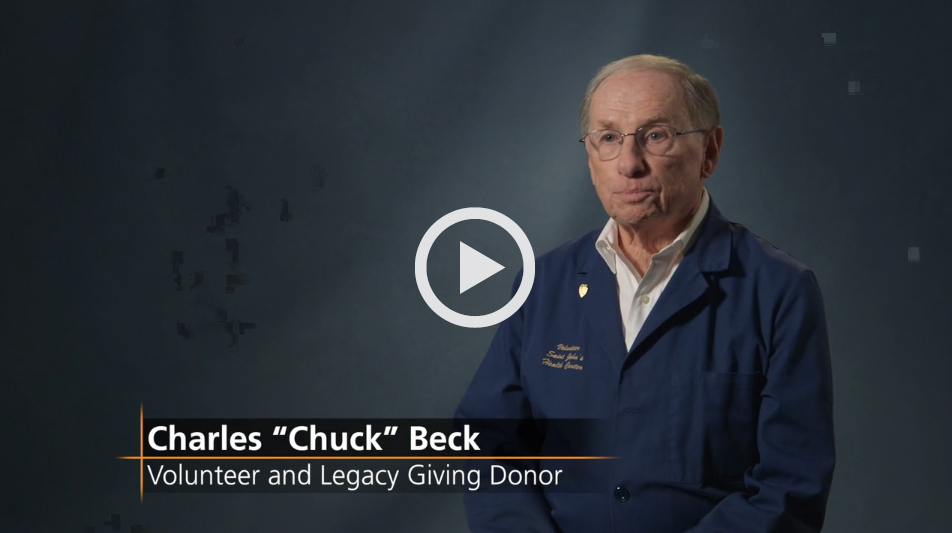

Legacy gifts are reflections of a donor's commitment to our world-class medicine, compassionate care and life-saving research. We recognize the generosity of our visionary supporters by welcoming them as members of our legacy society.

Learn MoreIRA Rollover

An IRA rollover allows people age 70½ and older to reduce their taxable income by making a gift directly from their IRA.

Learn MoreAbout Bequests

We are grateful for your consideration to include us your will or living trust. A charitable bequest is one of the easiest and most flexible ways that you can leave a gift to Saint John's Health Center Foundation that will make a lasting impact.

Learn MoreCharitable Gift Annuity

A charitable gift annuity is a great way you can make a gift to our organization and benefit. You transfer your cash or property to our organization and we promise to make fixed payments to you for life at a rate based on your age.

Learn More